Property values across Australia’s combined capital cities

increased by 3.8% over the second quarter of 2016 to take

them 5.5% higher over the first half of 2016 and 8.3% higher

over the 2015–16 financial year. This means the total value of all

residential dwellings in Australia has increased to $6.6 trillion.

Although the annual change in capital city home values remains

strong, it has slowed from a recent peak rate of growth of 11.1%

over the 12 months to July 2015.

Sydney and Melbourne continue to record a substantially higher

rate of growth in values compared to the remaining capital cities

with annual increases of 11.3% and 11.5% respectively. Most other

capital cities are recording value rises; however, only Hobart (+6.2%)

and Brisbane (+5.3%) have recorded annual value increases in

excess of 5%. Both Adelaide and Canberra have also seen values

rise over the year, up 2.2% and 3.9% respectively. Perth and Darwin

have continued to record declines in home values with falls of –4.7%

and –1.1%.

Rents however have fallen by –0.6% over the past year. CoreLogic

has been tracking rental rates since 1996 and these are the largest

declines recorded over that timeframe. With values rising and rents

falling, gross rental yields have slumped to historic low levels. Gross

rental yields across the combined capital cities have softened from

3.6% in June 2015 to 3.3% in June 2016.

The volume of newly advertised residential property for sale across

the capital cities is trending lower, with “new to market” property

listings now substantially lower than the same time last year. Brisbane

is the only capital city in which new listings are higher than they were

a year ago suggesting vendor confidence is improving. While there

is less newly advertised stock available for sale, the total volume of

stock advertised for sale (New listings plus re–listings) is higher than

a year ago. The only capital cities which currently have less stock for

sale than a year ago are Hobart and Canberra.

The annual rate of home value growth slowed a little in June and it

is anticipated the rate of home value appreciation will continue over

the second–half of 2016. Home values reached a low point in May

2012 and since that time combined capital city home values are 37%

higher with Sydney and Melbourne having recorded substantially

higher value increases than all other capital cities. Clearly this growth

can’t continue forever and with affordability stretched it is likely that

the rate of value growth will start to slow.

While the combined capital cities figure suggests the housing market

is recording strong growth, across each of the capital cities, housing

market conditions are very different. Capital gains are strong in

Sydney and Melbourne with much slower growth in most other cities,

while dwelling values are trending lower in Perth and Darwin. Sydney

and Melbourne continue to benefit for stronger economies which

is leading to greater job creation and ultimately superior population

growth. While overseas migration is slowing at a national level it is

actually picking–up in New South Wales and Victoria highlighting

strong economies with good job prospects will continue to attract

skilled migrants and drive housing demand.

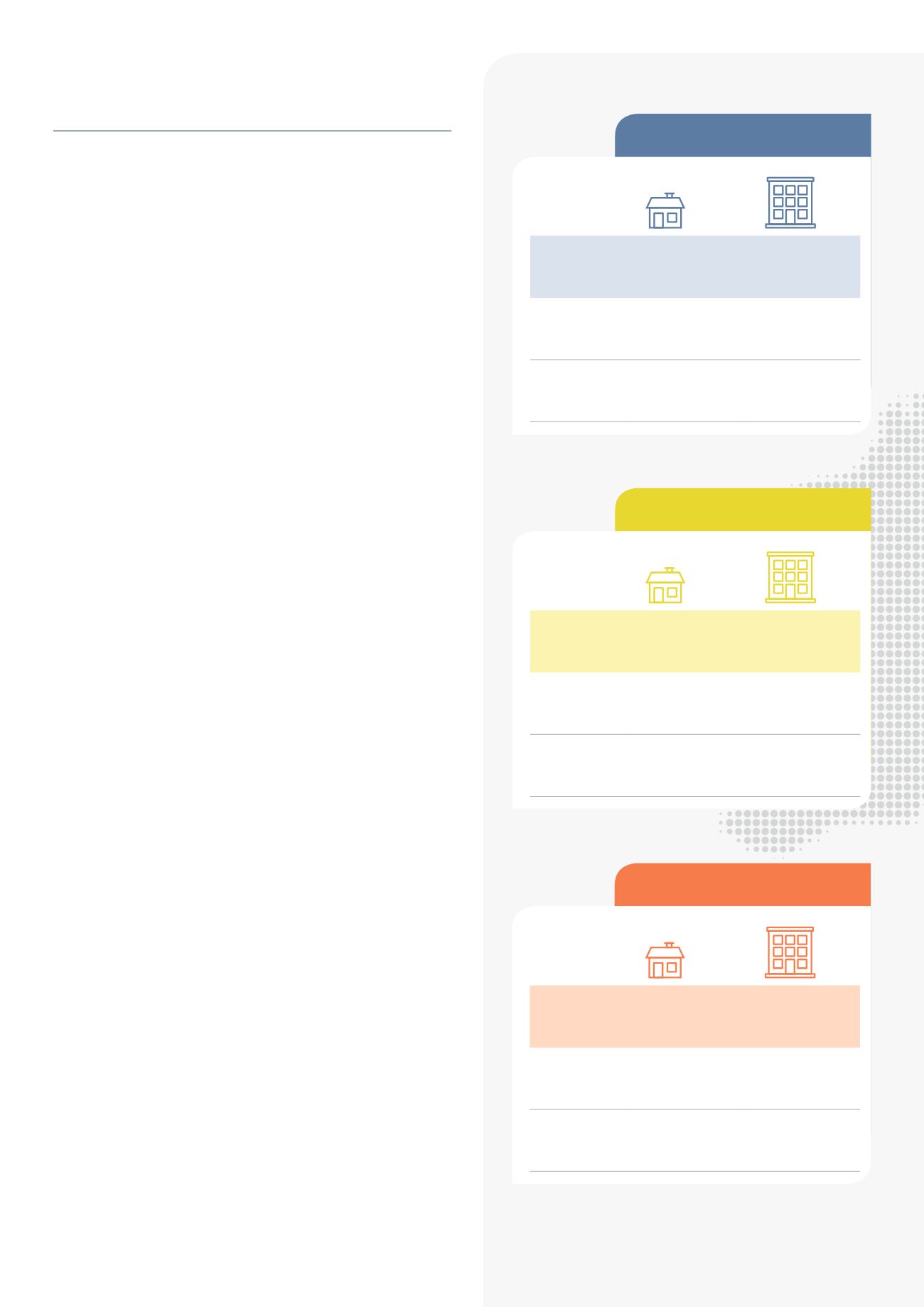

Property prices

continue their rise

Note: ‘this year’ = May 2016, ‘last year’ = May 2015

Median price figures & growth figures are to June 30, 2016

All statistics are based on data from the CoreLogic Indices suite, as at July 2016

Adelaide

Darwin

Houses

Units

Median Price

$450,000

$345,000

Growth

2.2%

1.7%

Days on Market

51

this year

54

this year

51

last year

59

last year

Discounting

–6.0%

this year

–6.7%

this year

–5.7%

last year

–6.6%

last year

Houses

Units

Median Price

$575,000

$404,000

Growth

–0.1% –4.9%

Days on Market

78

this year

136

this year

81

last year

100

last year

Discounting

–8.1%

this year

–16.2%

this year

–6.7%

last year

–8.4%

last year

Perth

Houses

Units

Median Price

$521,400

$405,000

Growth

–4.6% –5.5%

Days on Market

69

this year

71

this year

55

last year

70

last year

Discounting

–7.6%

this year

–8.8%

this year

–6.6%

last year

–7.1%

last year

2